Table of Contents

- Sole Proprietorship

- Partnership

- Corporation

- Limited Liability Company (LLC)

- How C Corp Differs from LLC

- Nonprofit Corporation

- Choosing the Right Structure

- * * *

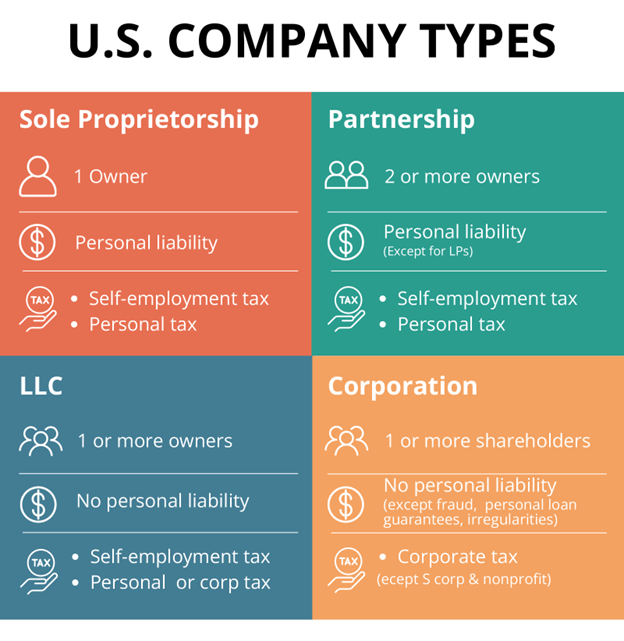

Choosing the right business structure is a fundamental decision that impacts every facet of your entrepreneurial journey. This choice influences not only your day-to-day operations but also how much your personal assets are at risk, and the amount of taxes you’ll owe.

From the simplicity of Sole Proprietorships to the comprehensive framework of Corporations, understanding the nuances of each structure is crucial.

We’ll explore the common business structures in the U.S., including Sole Proprietorships, Partnerships, Corporations (C Corp and S Corp), and Nonprofits, guiding you towards making an informed decision for your business venture.

Sole Proprietorship

Sole Proprietorship stands as the simplest and most straightforward business structure, where a single individual owns and operates the business. This direct ownership means there’s no legal distinction between the owner and the business, streamlining decision-making and administration.

The benefits of this structure are its ease of formation and simplicity in taxes, as profits and losses are directly reported on the owner’s personal tax returns, avoiding the complexities of corporate taxation.

However, this simplicity comes with a significant drawback: unlimited liability. The owner is personally responsible for all business debts and legal obligations. If the business incurs debt or faces a lawsuit, the owner’s personal assets, such as their home or savings, are at risk. Therefore, while a Sole Proprietorship offers the allure of full control and easy setup, it demands careful consideration of the potential financial and legal vulnerabilities.

Partnership

In the realm of business structures, a Partnership stands out as a collaborative arrangement where two or more individuals share ownership and operational responsibilities of a business. This structure is inherently flexible, allowing partners to pool resources, expertise, and capital to drive the business forward.

The main types of partnerships—General Partnerships (GP), Limited Partnerships (LP), and Limited Liability Partnerships (LLP)—offer varying degrees of liability and involvement, catering to different business needs and partner expectations.

General Partnerships are the most straightforward, with all partners sharing in the profits, losses, and managerial duties, as well as bearing unlimited liability for business debts. This means that each partner’s personal assets can be used to satisfy business debts and legal judgments.

Limited Partnerships introduce the concept of limited partners who invest capital but do not partake in day-to-day management, thus limiting their liability to the amount of their investment.

LLPs, meanwhile, provide all partners with protection from personal liability for certain obligations of the business, making it a preferred structure for professionals such as lawyers and accountants.

The formation of a Partnership often requires less paperwork and expense than corporations, making it an attractive option for small to medium-sized enterprises. The direct pass-through of profits and losses to partners’ personal tax returns simplifies the tax filing process, avoiding the double taxation faced by corporations.

However, partnerships also necessitate clear, detailed agreements to outline the distribution of profits, decision-making processes, and procedures for resolving disputes and handling the departure or addition of partners. Without such agreements, partnerships risk potential conflicts that could jeopardize the business.

While Partnerships offer the benefits of shared resources, complementary skills, and simplified taxation, they also demand careful planning and clear communication among partners to mitigate risks and ensure the smooth operation and longevity of the business.

Corporation

A Corporation is a legal entity distinct from its owners, providing the most robust separation between personal and business assets and liabilities. This structure is favored by businesses seeking to minimize the personal risk to shareholders while enjoying the benefits of substantial capital raising capabilities. In the U.S., corporations are classified mainly into two types: C Corporations (C Corp) and S Corporations (S Corp), each with its unique characteristics and tax implications.

C Corporations are the standard form of corporate entity, where the business is legally considered separate from its owners. This separation affords shareholders limited liability protection, meaning their personal assets are shielded from business debts and legal judgments.

C Corps can issue stock to an unlimited number of shareholders, making them particularly attractive for businesses looking to raise capital through public or private stock offerings. However, this benefit comes with the drawback of double taxation: the corporation’s profits are taxed at the corporate level, and dividends paid to shareholders are taxed again on their personal income tax returns.

S Corporations, conversely, are designed to avoid this double taxation. Profits and losses are “passed through” directly to shareholders’ personal tax returns, similar to partnerships and sole proprietorships. However, S Corps face strict eligibility criteria, including limits on the number and type of shareholders. This structure balances the desire for limited liability protection with the advantage of single-level taxation, making it suitable for smaller businesses that meet the eligibility requirements.

Despite these advantages, corporations are subject to rigorous regulatory oversight, reporting requirements, and operational complexity. They require a formal structure with a board of directors, corporate officers, and annual meetings. This legal and procedural framework supports the corporation’s growth and longevity but demands a significant commitment to governance and compliance.

Limited Liability Company (LLC)

Limited Liability Companies (LLC) offer a structure that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. This dual advantage makes LLCs an attractive option for many business owners. In an LLC, members are protected from personal liability for business debts and claims, which means that in the case of legal action or business failure, the members’ personal assets, such as homes, cars, and personal bank accounts, are typically not at risk.

However, similar to a C Corporation, the shield of limited liability is not absolute. The protection can be voided if the owners do not maintain a clear separation between their personal dealings and the business’s operations, or if they engage in fraudulent practices, fail to contribute to the LLC after initial funding (undercapitalization), or personally guarantee a debt or a loan.

Moreover, LLCs offer flexibility in management and do not require the same level of formalities as C Corporations, such as holding annual meetings or creating a board of directors. This flexibility can be beneficial for small to medium-sized businesses that desire legal protection without the formalities and record-keeping required in a corporation.

Overall, the LLC is a versatile structure that is conducive to protecting personal assets while providing operational flexibility and favorable tax treatment.

How C Corp Differs from LLC

Understanding the distinction between a C Corporation and a Limited Liability Company (LLC) is crucial for entrepreneurs as they navigate the decision of how to structure their business. While both offer limited liability protection, shielding owners’ personal assets from business debts and liabilities, the similarities largely end there, highlighting their unique operational and tax implications.

A C Corporation is a legally independent entity that is separate from its owners, known as shareholders. This structure allows C Corps to offer stocks, which can be beneficial for raising capital from a broader range of investors. However, one of the most significant differences comes in the form of taxation. C Corps are subject to corporate income tax on profits, with an additional layer of tax applied to dividends distributed to shareholders, known as double taxation.

In contrast, LLCs offer a more flexible management structure and are not bound by the strict operational requirements that govern corporations. From a taxation perspective, LLCs typically benefit from pass-through taxation, where profits and losses are reported on the owners’ personal tax returns, avoiding the double taxation faced by C Corps. This flexibility and tax advantage make LLCs an attractive option for small to medium-sized businesses that value operational flexibility and tax efficiency.

Ultimately, the choice between a C Corp and an LLC hinges on the business’s financial strategies, growth objectives, and the preferred level of operational complexity. Each structure offers distinct advantages and limitations, underscoring the importance of aligning the choice with the company’s long-term vision and operational needs.

Nonprofit Corporation

Nonprofit Corporations are unique entities formed to serve the public good rather than to earn profits for shareholders. These organizations are dedicated to charitable, educational, religious, literary, or scientific purposes. A defining feature of nonprofit corporations is their eligibility for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code, which exempts them from federal income taxes on profits related to their exempt purposes. This tax-exempt status can be crucial for securing donations, grants, and other forms of financial support, as it often allows donors to claim tax deductions for their contributions.

Despite not being profit-driven, nonprofit corporations share some structural similarities with for-profit corporations, including limited liability protection for directors and officers. This means that personal assets are generally protected from the corporation’s debts and liabilities. Nonprofits are also required to follow formalities such as holding regular board meetings, maintaining minutes, and adhering to state and federal regulations specific to nonprofit operations.

However, the focus of a nonprofit is not on distributing profits to members or leaders but on reinvesting all funds back into its mission and operations. This commitment to public service over profit requires a clear mission statement, strategic planning, and diligent oversight to ensure that the organization’s activities align with its tax-exempt purposes. Managing a nonprofit demands a deep understanding of the legal and financial responsibilities involved, including strict compliance with fundraising, financial reporting, and operational guidelines designed to uphold the public trust and ensure transparency.

Choosing the Right Structure

Selecting the appropriate business structure is a critical decision that influences your company’s legal liability, tax obligations, and capacity to attract investment. It requires a thoughtful analysis of your business goals, financial practices, and the level of legal protection you seek.

Sole Proprietorships and Partnerships offer simplicity and tax advantages through pass-through taxation but expose owners to personal liability for business debts.

Corporations, both C and S types, provide limited liability protection, which shields personal assets but come with more complex regulatory and tax considerations.

Nonprofit Corporations cater to organizations focused on charitable purposes, offering tax-exempt status but requiring strict adherence to regulatory standards and operational limitations.

Choosing the right structure involves weighing the potential risks against the operational and financial benefits. Liability concerns, tax implications, funding needs, and the desire for operational flexibility are all crucial factors. For example, startups planning to seek outside investment might lean towards a Corporation for its fundraising advantages, while small business owners prioritizing tax simplicity might prefer an LLC or S Corporation.

Consultation with legal and financial advisors is essential in this decision-making process. Their expertise can provide invaluable insights into the nuances of each structure, helping you align your business structure with your long-term objectives and operational strategies. Ultimately, the right structure should not only address current needs but also accommodate future growth and changes in business strategy.

* * *

Selecting the right business structure is more than a mere formality; it’s a strategic decision that sets the foundation for your company’s legal framework, tax obligations, and growth potential.

From the simplicity and direct control of Sole Proprietorships and Partnerships to the robust liability protection and fundraising capabilities of Corporations, each structure carries its unique set of benefits and considerations. Nonprofit Corporations offer a path for organizations dedicated to charitable causes, emphasizing service over profit.

Meanwhile, understanding the differences between entities like C Corporations and LLCs is crucial for navigating the complexities of taxation and operational flexibility. Engaging with legal and financial advisors to explore these options can provide tailored insights that align with your business goals. Keep in mind that the structure you choose will influence every aspect of your business journey, highlighting the importance of making an informed decision that supports your vision and facilitates your success.