Table of Contents

- The Dell XPS Laptop Range

- eBay and PayPal and Credit Card Buying Hack

- PayPal Pay in 4 and eBay

- What is PayPal Pay in 4?

- Overview of this Case Study

Buying a laptop AND building business Credit via eBay and PayPal (Case Study)Disclaimer: This is a case study and for informational purposes only and does not constitute any financial advice whatsoever. We were not asked to write this, were not paid to write this, and do not endorse any of the companies or providers mentioned in this article – these are simply the steps, sites, banks, and providers I used and based this case study solely on.

Not all credit and creditworthiness relies solely on Transunion and Equifax. Banks and gateways like Chase, PayPal, and Synchronicity judge you on how you manage your credit facilities with them and are likely to base their judgment solely on that – for example missing a payment or having high balances, so you need to manage performance in more than one place. Also, you need to keep using credit facilities in order to have a credit rating. If you dump all of your credit cards, after a while, your credit management score will go down. For example, if you have $30k in credit and use 25% of it but remove a credit card with a $10k limit and 0% utilization, you risk increasing your total utilization and dropping your credit score.

The Dell XPS Laptop Range

Since I was a software engineer at Dell in the 1990s, I’ve always owned or used a Dell laptop – 20 of them in fact. I currently use a Dell XPS 17 and a Dell XPS 15 which I use when going to in-person meetings or into Manhattan.

I still have my Dell XPS 15 with an imprint of my shoulder blade from the time I got hit by an SUV outside the Javits Center in NY – forever dented in the otherwise pristine brushed metal cover.

The Dell XPS is a nice laptop – it looks good and has many features – like 4k res, flipping 180 degrees into a tablet with touch screens, and retina and fingerprint recognition (depending on the model).

They aren’t Macs but I’ve always been a Windows guy they are pretty pricey, with a high-end XPS’s 17 with 32 GB RAM costing $4,000 new!

Of course, if you’re trying to improve your credit or just find a new laptop – you can use this with any purchase or item in most cases.

eBay and PayPal and Credit Card Buying Hack

So you don’t need a credit card – which helps if you’re using this to boost your credit but if you have one especially if you earn points or miles, then you should use one.

eBay for Laptops

Refurbishers list a wide range of Dell XPS laptops on eBay, often for 25% of the list price or less. Many are approved EBay refurbishers which gives some extra peace of mind for knowing that you’re buying something that has been through some quality control.

If buying Windows, especially 11 which has always been a resource-heavy OS – even if you’re just running Chrome – I recommend a minimum of 32Gb of RAM. Yes, you can run on 16 GB but Chrome and Windows have decided that despite RAM being a major speed limiting factor, the best way is for both of them to make a land grab for it. Firing up Chrome with 5 extensions will use up 45% of however much RAM you have…

Credit Building Notes

Credit building and maintenance is a continuous process – you start with a starter card, then a low % card, then a high points card…then a card with more perks and privileges to make the nuisances of life like traveling with all the King’s and Karen’s waiting to be thrown off flights more bearable

Prerequisites that I used before I used this hack

- Buy a few items on PayPal beforehand

- Attempted this only after I had been offered a “Pay-in-4” deal

- Get a Business PayPal Account

- Associate it with eBay (same owner, pretty easy)

- Tie in your Business Credit card

- Get a business starter credit card

Remember: I pay off my credit card weekly!

PayPal Pay in 4 and eBay

After finding my perfect XPS, I add warranty protection and then check out, opting for the PayPal Pay-in-four and then select my Business Credit Card (in this case a Chase Ink Card).

This way I’m getting interest-free payments – of course if I tied this straight to my debit card, I’d still be avoiding any interest but by going via my credit card, I get points and added protection, if just in case I didn’t have the $250 monthly payment in my current account. But if I didn’t pay off this balance on my Credit Card, I would actually be incurring interest!

Not all credit and creditworthiness relies on just the credit unions – so this lets you improve your credit rating for a small amount – in this case just $250 a month – while also getting a great bargain on a laptop, and still earning miles/points/$s if you already have a reward credit card or if you need to repair your credit.

What is PayPal Pay in 4?

The PayPal “Pay in 4” service lets you split your online purchases into four interest-free payments over six weeks. It’s a type of “buy now, pay later” (BNPL) financing option.

Here’s how it works:

- You make a purchase online at a store that accepts PayPal.

- At checkout, you choose PayPal Pay in 4 as your payment method.

- You’ll pay an initial down payment of 25% of the total purchase price.

- The remaining balance is then split into three bi-weekly payments (every two weeks) that you’ll pay off over the next six weeks.

Overview of this Case Study

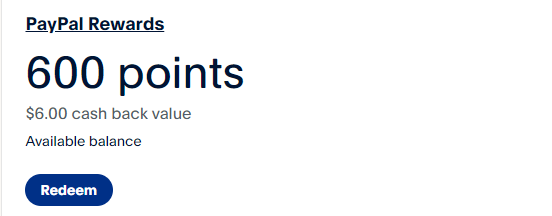

To improve my credit rating across 3 platforms

- PayPal

- My bank (Chase)

- Credit Score Services