Table of Contents

ToggleIntroduction: Your Path to Financial Freedom

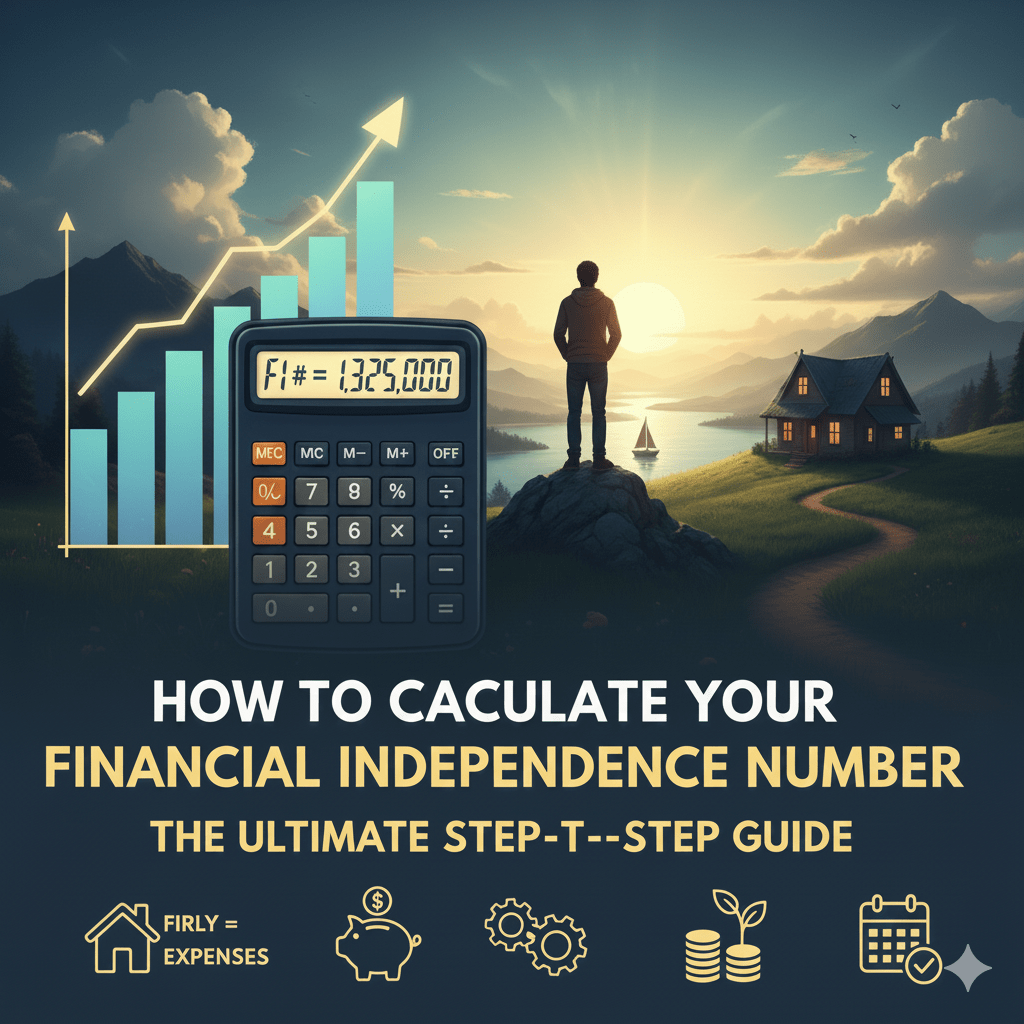

The concept of Financial Independence (FI) is the ultimate goal for millions seeking freedom from the traditional work cycle. It’s the target point on your journey where your investment returns can sustainably cover your annual living expenses—meaning you no longer need an income from a job.

But how do you know when you’ve reached it? The answer lies in calculating your FI Number (or FIRE Number), the magic amount of money you need in your portfolio. This article will provide the clear step-by-step process and essential guideline for this critical calculation.

What is the FI Number? The Core Concept

The FI Number is the total assets you must accumulate to achieve financial independence. The entire concept hinges on the relationship between your annual expenses and a sustainable withdrawal rate from your investments.

The Foundation: The 4% Rule and 25x Rule

The most widely accepted strategy for calculating the FI Number comes from the 4% Rule.

-

The 4% Rule: This rule suggests that you can safely withdraw 4% of your total portfolio value in the first year of retirement, and then adjust that dollar amount for inflation every subsequent year, with a very high probability (historically over 95%) of your money lasting 30 years or more.

-

The 25x Rule: To reverse-engineer this, if 4% is your safe annual withdrawal, then your total necessary portfolio must be 25 times (or $1 / 0.04$) your desired annual spending.

⚙️ Step 1: Determine Your True Annual Expenses

Your FI Number is entirely dependent on your lifestyle and annual costs. Be honest and thorough here; a mistake in this step means a mistake in your final target.

The Expense Calculation Process

Start by analyzing your current budget and spending over the last 12 months. This is your foundation.

| Expense Category | Example Costs |

| Housing | Mortgage or rent, utilities, insurance |

| Food | Groceries, dining out, coffee |

| Transportation | Car payments, gas, maintenance, public transport |

| Insurance | Health, life, disability, home/renters |

| Taxes | Property taxes, estimated income taxes in retirement |

| Personal | Entertainment, travel, hobbies, clothes |

| Debt | Monthly loan payments (if not paid off before FI) |

Important Consideration: The “FI Budget” vs. Your Current Budget

Crucially, your FI budget may differ from your current one. Ask yourself:

-

Will my expenses change in retirement? (Mortgage payments might disappear, or travel costs might increase).

-

Will I still have debt (e.g., student loans)? (The advice is usually to pay off high-interest debt first.)

-

What about healthcare? This is a huge factor, especially before Social Security or Medicare eligibility.

Example: If your current annual expenses are $60,000, but you plan to pay off your mortgage ($12,000/year) and spend an extra $5,000 on travel, your new annual FI expense is $60,000 – $12,000 + $5,000 = $53,000.

📊 Step 2: Apply the 25x Rule to Find Your FI Number

Once you have your final, realistic annual expense estimate (let’s use $53,000 from the example above), you simply apply the 25x rule.

Calculation Example:

-

Annual Expenses: $53,000

-

Multiplier: $25

-

FI Number: $53,000 X 25 = $1,325,000

This means you would need $1,325,000 in your investment portfolio to sustainably generate the necessary cash flow.

🚀 Step 3: Optimize and Account for Key Factors

The simple 25x calculation is a great guideline, but for robust planning, you must factor in other critical variables.

A. The Safe Withdrawal Rate (SWR)

The 4% rate is an estimate based on historical returns using a diversified portfolio of stocks and bonds.

| Withdrawal Rate | FI Multiplier | Probability of Success (30 Years) |

| 3.5% | ~ 28.5 X | Extremely High (Near 100%) |

| 4.0% | 25 X | High (95%+) |

| 5.0% | 20 X | Lower (Often below 85%) |

If you want a higher safety margin (perhaps because you are retiring very early, or before the traditional retirement age), you may consider using the 3.5% rate. This is a personal decision based on your risk tolerance and comfort with potential market changes.

B. Inflation and Taxes

-

Inflation: The 4% rule inherently accounts for inflation, as the withdrawal amount is adjusted yearly. However, be aware that your expense projection should be in today’s dollars. Do not try to guess future expenses; the calculation handles the future cost adjustments.

-

Taxes: If your investments are primarily in taxable accounts (non-registered or non-tax-advantaged), you must subtract estimated capital gains and income taxes from your gross withdrawal. Work with a financial advisor to estimate this impact accurately.

C. Considering Social Security and Pension

If you plan to receive Social Security or a private pension starting at a specific age, you can subtract that annual income from your required living expenses before applying the 25x multiplier.

Example (Continuing from Step 2): If you expect $10,000 per year from a pension later in retirement, your required portfolio withdrawal drops from $53,000 to $43,000.

New FI Number: $43,000 \times 25 = $1,075,000}. This significantly lowers your target!

Step 4: Track Progress with the Savings Rate and Net Worth

Calculating the FI Number is just the start. The key to hitting it rapidly is maintaining a high savings rate and regularly tracking your progress.

The Savings Rate

Your savings rate (how much of your annual income you save and invest) is the single biggest factor in determining your timeline to FI.

| Savings Rate | Time to FI (Years) |

| 10% | approx 51 |

| 25% | approx 32 |

| 50% | approx 17 |

| 75% | approx 7 |

This is the central reason the FIRE community is obsessed with reducing expenses and maximizing income.

Net Worth Calculation

To see how close you are to your goal, track your Net Worth (Total Assets minus Total Liabilities).

-

FI Ratio: Current Net Worth / FI Number

When this ratio hits 1.0 (or 100%), you have achieved financial independence.

Conclusion: Your Customized FI Plan

The calculation for your financial independence number provides the definitive target for your investment strategy. While the 25\times rule is the reliable guideline for everyone, remember that your FI Number is personal to your specific circumstances, desired lifestyle, and risk tolerance.

Start by being honest about your expenses, create your personal plan, and commit to a high savings rate. With disciplined investment and clear goals, financial independence is within reach.